According to sources, ThyssenKrupp is considering listing its steel division independently as an alternative to selling the division, because there is growing opposition to selling it to the Liberty Steel Group.

ThyssenKrupp executives are studying the transfer of shares in the steel division to existing shareholders. For many years, ThyssenKrupp has been working hard to find a permanent solution for its steel division, and splitting the division will be a new attempt by the company. The company’s steel division is one of the leading metal suppliers in the German automotive industry, employing approximately 27,000 employees.

According to sources, after union executives and some major shareholders raised concerns, some members of the Supervisory Board have called on ThyssenKrupp to explore an alternative plan to avoid selling the unit to Liberty Steel Group. Currently, Liberty has not yet given a binding tender offer, and the company will provide it later this month.

Some people pointed out that the German valve manufacturer Essen (Essen) had a similar transaction, but the results were not satisfactory. In 2012, Essen sold its stainless steel unit Inoxum to Outokumpu Oyj. Some assets were repurchased after a year.

ThyssenKrupp has not yet made a final decision on the sale of the steel division or the spin-off. A ThyssenKrupp spokesperson said the company may still choose to develop its own steel business, but he declined to say more. A Liberty spokesperson declined to comment.

Prior to this, ThyssenKrupp has confirmed that it is negotiating with Liberty to sell its steel division. With global steel supply surplus and huge pension deficits, the company’s steel division struggled.

Shareholder concerns

ThyssenKrupp’s largest shareholder representative Alfried Krupp von Bohlen und Halbach Foundation is concerned about Liberty’s bidding power and management financing model. The ThyssenKrupp Foundation owns 21% of the company’s outstanding shares, and Ursula Gather, chairman of the foundation’s board of directors, is also a member of the company’s supervisory board. Barbara Wolf, spokesperson for the ThyssenKrupp Foundation, said that the executive committee should “review all possibilities in order to make the best decision for the steel sector.”

Sources said that some ThyssenKrupp shareholders also have concerns about Liberty’s transparency and trustworthiness in financing transactions. Liberty Steel belongs to the GFG Alliance, and the company’s structure is relatively loose. The rapid expansion of Liberty Steel in the past five years has been remarkable, but GFG is also facing scrutiny due to its opaque business structure.

ThyssenKrupp, once synonymous with German industrial power, is now fighting for survival. The new crown epidemic has deepened the company’s deep-rooted structural problems. Currently, the company employs more than 100,000 employees.

In recent months, business conditions in the steel industry have improved. Last year’s epidemic led to a reduction in steel supply. In the second half of 2020, market demand exceeded expectations, and steel prices also rose. With inflation intensifying and stimulus measures boosting construction activity, European steelmakers also look forward to benefiting from the general rise in commodity prices.

ThyssenKrupp’s automotive business sales in 2019 were US$11.86 billion, ranking 21st in the Automotive News Global Top 100 Parts Suppliers list.

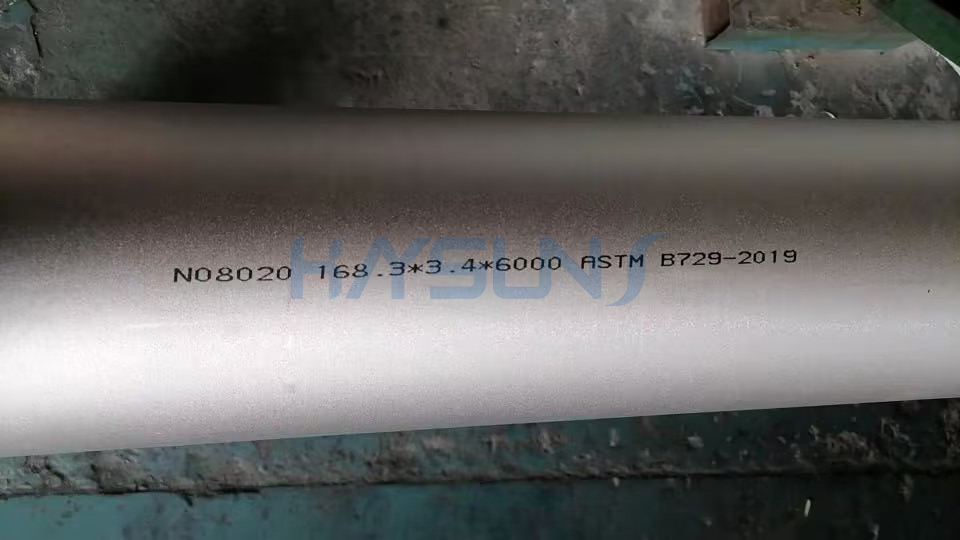

Posted by KAYSUNS, the stainless steel pipe and fittings supplier in China.