India To Raise Import Tariffs On Stainless Steel Welded Pipes From China And Vietnam

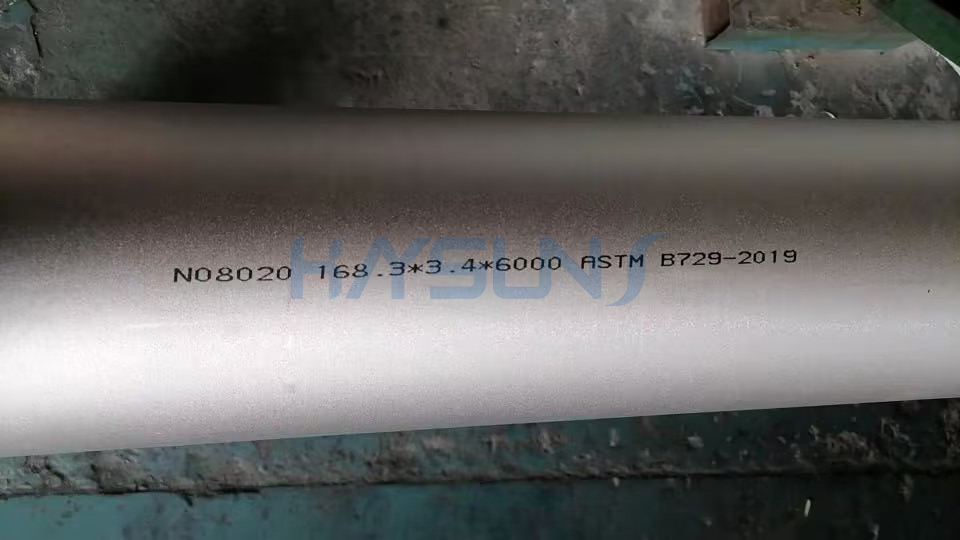

According to an order of the Indian Ministry of Finance on September 10 local time, India will impose tariffs of 12% to 30% on some steel products imported from China and Vietnam “to protect and promote the local industry”. Reuters reported that this means that over the next five years, India will impose duties on welded stainless steel pipes exported from China, the world’s largest steel producer, as well as Vietnam.

Reuters pointed out that after the border conflict between China and India in 2020, India has increased scrutiny against Chinese companies, disrupting the investment plans of large Chinese companies. However, India’s foreign minister claimed on Sept. 10 local time that New Delhi “has not rejected business activities from China,” but noted that the issue is in which industry sectors and on what terms China operates. However, Su Jiesheng did not elaborate on this either.

In August this year, the Indian government launched an anti-dumping investigation into imports of some steel products from Vietnam. Previously, Indian steel producers have been calling on the government to raise tariffs on Chinese steel products. on June 29, Reuters quoted a government source with direct knowledge of the matter as saying that negotiations were underway within the Indian government to increase the amount of steel imported from China.

The report said that New Delhi is now keeping a close eye on Chinese steel exports to India as China has been sitting firmly as India’s largest steel supplier in recent months. The source said, “India’s steel ministry has informed India’s commerce and industry ministry of the rise in imports, and the industry has asked for an investigation in this regard.”

According to preliminary Indian statistics obtained by Reuters earlier, in the fiscal year 2023/24 ending in March this year, India has become a net importer of finished steel. Among them, China is India’s largest steel exporter, with shipments reaching 2.7 million tons, almost double the previous year.

This trend has continued in recent months, the report said. Preliminary data from the Indian government show that, as the world’s second-largest crude steel producer, India imported 1.1 million tons of finished steel products from April to May this year, up 19.8% year-on-year from the same period last year, hitting a new record high in nearly five years, and continuing to be a net importer.

The current spurt in economic activity and wider infrastructure revamping in India is pushing steelmakers to invest more and increase capacity. According to India’s Economic Times, India seeks to triple its domestic steel production capacity by 2047 to 500 million tons per year.

Some time ago, India had deliberately provoked the Sino-Indian border conflict, and then intensified in a number of aspects of China, all colors of anti-China “dirty tricks” is staggering: boycott of Chinese goods, delayed the clearance of Chinese goods in various ports, blocked hundreds of Chinese apps, restrictions on Chinese investment projects ……

However, it is worth noting that, looking at the “Make in India” program road is long and difficult, India recently frequently release wind, hope that China’s investment flow back, while not forgetting to speculate on the relevant concerns.

Japanese media “Nikkei Asia” reported on September 10, despite the United States Apple began production of a new generation of iPhones in India, but India is still far from the goal of global manufacturing power, the country’s industrial investment, new manufacturing jobs and expand the manufacturing sector in the proportion of gross domestic product (GDP), lagging behind. In addition, India’s production subsidies and protective tariffs have had a worrying incentive effect, and many companies are not rapidly increasing their manufacturing capacity.

Bank of India Baroda economists said that between April and June this year, private sector investment in India was weak, falling to a 20-year quarterly low. As of March this year, 2023/24 fiscal year total foreign direct investment fell for the second consecutive year.

There have been calls from within and outside the Indian government that the solution to these woes is to allow more Chinese investment into India. But reports say the topic is still highly sensitive in New Delhi, where the Modi government needs to weigh many issues in terms of boosting domestic manufacturing and avoiding increased “dependence” on China.